Stress Testing Solar

Utility-Scale Solar – Return on Investment

The revenue stream from utility-scale solar investments comes in many flavors. Purchase power agreements (PPA), virtual purchase power agreements (VPPA), contract for differences, and avoided costs are some of the more common sources of revenue.

Regardless of the type of agreement, a prudent method for understanding the risk and reward of your solar investment is to perform a revenue stress test using a fundamental market model.

Case Study: Wilmington, N.C.

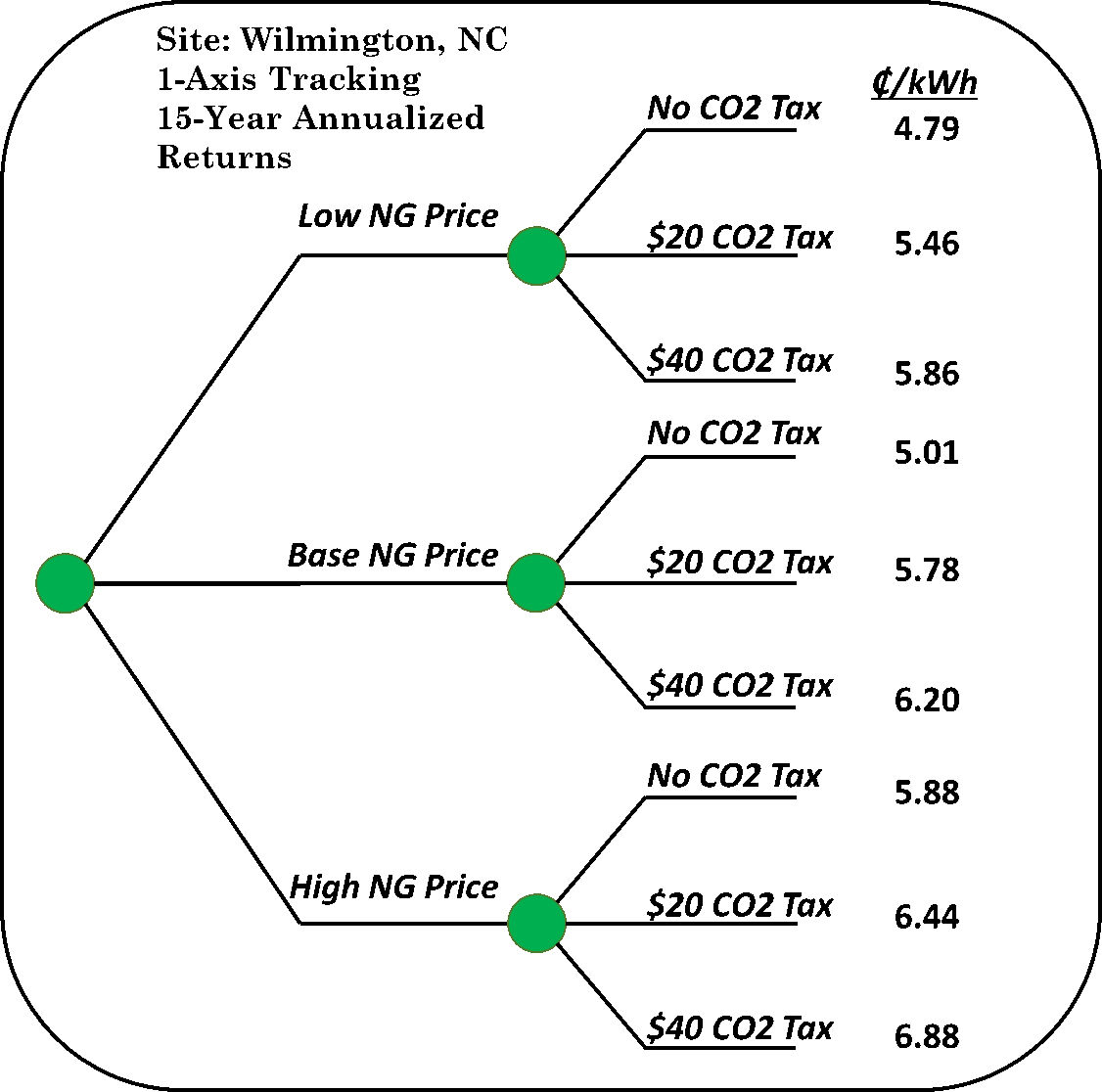

To illustrate the impact of stress testing, let’s consider a 10 MW single axis tracking system located at Wilmington, NC. The two key uncertainties we’ll consider are future natural gas prices and a possible carbon tax. For natural gas, we’ll use the low, base, and high natural gas forecast from the AEO2017 report. For a carbon tax, we’ll consider no tax, a $20/ton tax, and a $40/ton tax.

The two uncertainties and three possible states creates nine possible outcomes as illustrated by the decision tree.

To project the 15-year annualized revenue (₵/kWh), Horizons Energy used the EnCompass market model and our proprietary national database to perform the simulation.

Not surprisingly, the annualized solar revenue is lowest in the Low NG, No CO2 Tax branch (4.79 ₵). And, the revenue is highest in the High NG, $40 CO2 Tax branch (6.88 ₵).

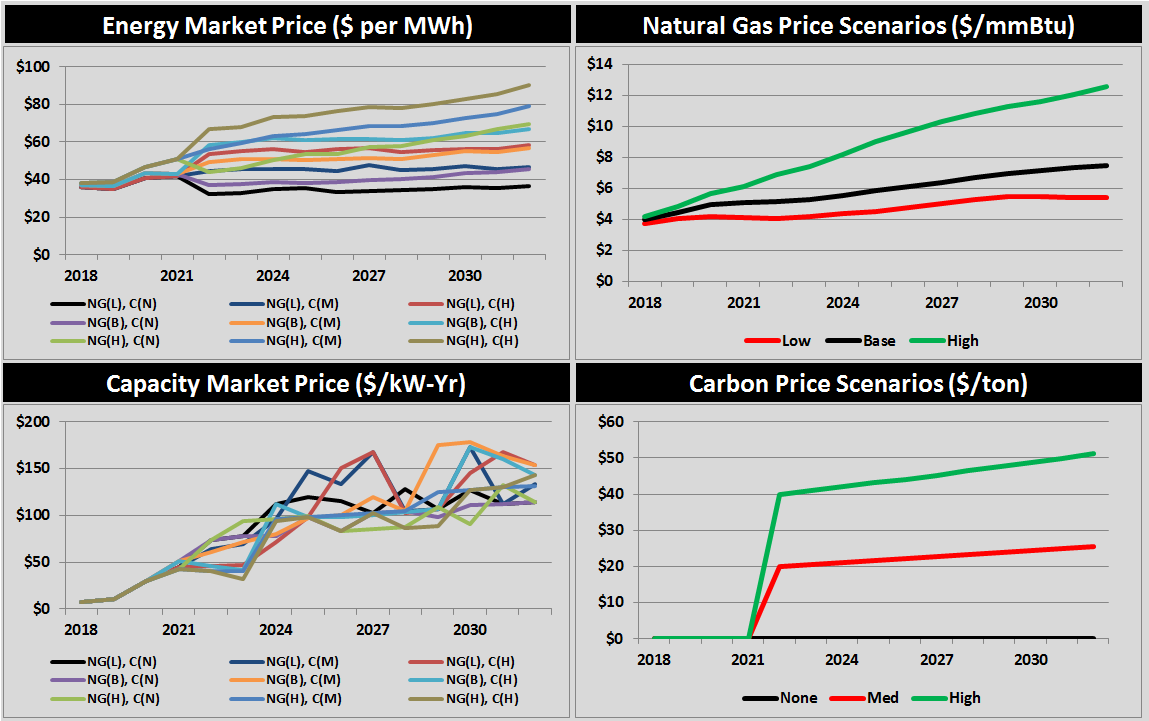

Wholesale Market

The graph below illustrates the wholesale market prices driven by the three levels of natural gas price combined with three levels of a carbon tax creating nine revenue streams for both energy and capacity. The hourly solar output for the single axis tracking system is applied to the hourly wholesale energy prices to produce 15-year annual returns. The returns are annualized using a 9% discount rate.

Case Study Payoff: Wilmington, N.C.

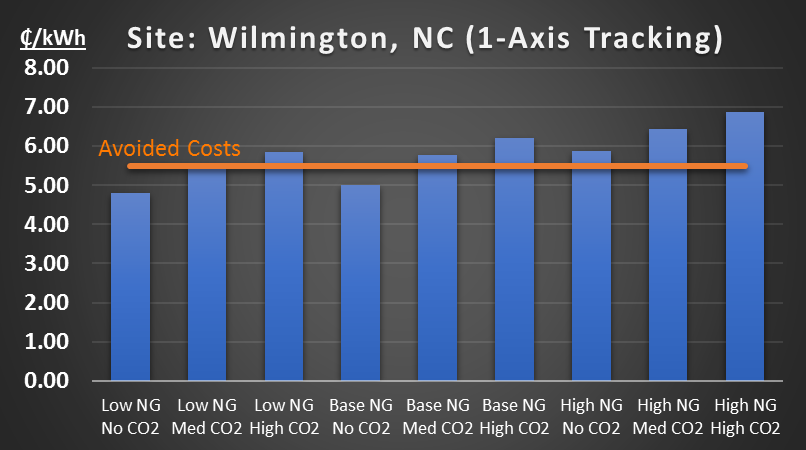

In our Wilmington case study, the off-taker is the local utility who pays the solar site owner an assumed avoided cost of 5.5 ₵/kWh for the next 15 years (orange line). In this example, the utility is taking the risk and will make or lose money as the markets deviate from the avoided cost.

However, had the solar site owner chose to sell the output directly into the wholesale spot market they would be taking the risk and perhaps the reward.

It all boils down to the understanding the risk and possible payoffs.

Conclusion

In our Wilmington case study, the loss in the low case was ($1,000,000), while the gain in the high case was $2,000,000. This wide spread of possible outcomes illustrates the need to carefully understand the possible outcomes of the solar investment.

About Horizons Energy Working with a variety of participants in North American electricity markets, Horizons Energy provides in-depth market analysis and Software as a Service (SaaS) solutions including SOLAR FLARE$.